Asset-Based Capital Inc. Redefining Accessibility in Commercial Lending

In an industry often bogged down by rigid credit scores and complex debt-service coverage ratio (DSCR) calculations, Asset Based Capital, Inc. (ABC) stands out by returning to the fundamentals of lending: the value of the asset itself. Led by industry veteran Rick Gnafakis, the Great Neck, NY-based firm has carved out a niche as a flexible, responsive partner for real estate investors and small business owners nationwide.

A Different Kind of Underwriting

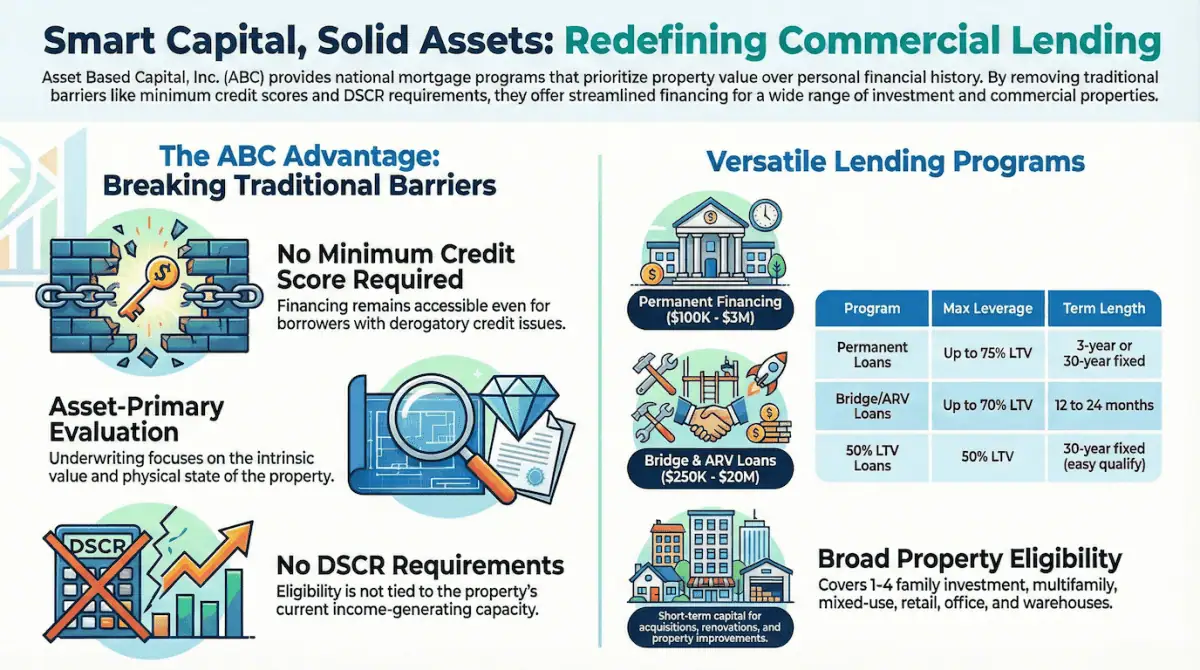

The hallmark of Asset Based Capital’s approach is its focus on the property’s value and condition rather than the borrower’s personal financial history. While traditional banks may turn away deals due to fluctuating cash flows or less-than-perfect credit, ABC operates with:

- No Minimum Credit Score: Financing remains accessible to those with derogatory credit.

- No DSCR Requirements: Eligibility is not tied to the property’s current income-generating capacity, making it an ideal choice for repositioning projects.

- Asset-Primary Evaluation: Loans are based primarily on the collateral’s intrinsic value and physical condition.

Versatile Programs for Every Property Type

Whether an investor is looking for a long-term hold or a quick turnaround, ABC offers structured programs tailored to a wide array of property types, including 1-4 family investment, investment condos, multifamily(no unit maximum), mixed-use, retail, office, commercial condos, warehouses/light industrial, auto repair(no gas), daycare centers and restaurants.

Permanent Financing

For those seeking stability, ABC offers both 3-year fixed (30-year amortization) and 30-year fixed-rate loans as a robust alternative to high-interest, short-term hard money.

- Loan Amounts: $100,000 to $3,000,000.

- High Leverage: Up to 75% Loan-to-Value (LTV) depending on property type and 90% Combined Loan-to-Value (CLTV) on purchases.

- Flexibility: Features flexible pre-payment options to suit evolving investment strategies.

Podcast

Bridge and ARV Fix/Flip & Fix/Hold Loans

For investors needing to move quickly or finance improvements, ABC’s bridge programs provide the necessary speed and capital.

- Speed & Scale: Loans from $250,000 up to $20,000,000.

- Short-Term Focus: 12 to 24-month terms designed for acquisitions, renovations, or “bridging” the gap to permanent financing.

- LTV Limits: Up to 70% LTV, allowing borrowers to unlock equity or secure new assets rapidly.

- Property types: Primary focus given to 1-4 family investment, multifamily(no unit maximum) & mixed use. Other property types are also considered.

National Reach with Local Expertise

While headquartered in New York, Asset Based Capital, Inc operates across most of the United States. Their programs are available in all states except for California, Arizona, Nevada, Alaska, Hawaii, South Dakota, and North Dakota. Loans in Michigan and Illinois are evaluated individually.

For investors tired of the “no” that often comes with traditional commercial lending, Asset Based Capital, Inc. offers a pathway to “yes” by focusing on the property’s potential rather than the borrower’s past.

Transactions evaluated on a case-by-case basis:

- Vacant land if located in the NY metropolitan area.

- Construction for 1-4 family investment, multifamily(no unit maximum) & mixed use if located in NJ, NY & CT

Contact Information:

- Principal: Rick Gnafakis

- Phone: 516-621-5955 x 401

- Email: rick@assetbasedcap.com

- Address: 505 Northern Blvd, Ste 200, Great Neck, NY 11021