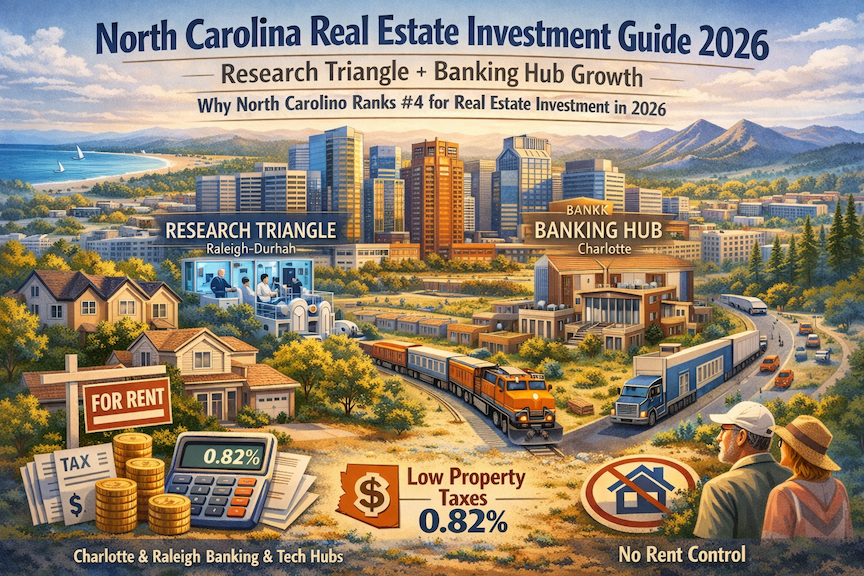

North Carolina Real Estate Investment Guide 2026: Research Triangle + Banking Hub Growth

Why North Carolina Ranks #4 for Real Estate Investment in 2026

North Carolina combines landlord-friendly 5-day eviction timelines, balanced regulations, and explosive growth across Raleigh-Durham (Research Triangle biotech boom) and Charlotte (2nd largest US banking center) driving 2.7% GDP expansion. With property taxes averaging just 0.82% (11th lowest nationally), no rent control laws, and four metros in the top 50 investment markets (Charlotte, Raleigh, Greensboro, Durham), North Carolina offers investors diversified economic anchors from technology and finance to manufacturing and healthcare, plus coastal appreciation and mountain resort STR opportunities.

- Why North Carolina Ranks #4 for Real Estate Investment in 2026

- Why North Carolina Delivers Balanced Growth + Cash Flow

- Legislative Landscape: Balanced Framework Favoring Landlords

- Top 3 High-Growth Metropolitan Statistical Areas (MSAs)

- Investment Risk Profile: Balanced Assessment for 2026

- FAQ: North Carolina Real Estate Investment Guide

- Lender Perspective: Optimal Loan Products for North Carolina Investments

Why North Carolina Delivers Balanced Growth + Cash Flow

Macro Economic Drivers (2026 Data)

Population Growth:

- +1.3% annual growth rate (6th fastest in US)

- Net domestic migration: 135,000 residents annually since 2020

- Raleigh metro: 75+ new residents daily, fastest-growing large metro in Southeast

- Charlotte metro: Financial services job growth attracts high-earning transplants

GDP Performance:

- North Carolina GDP: $710 billion (11th largest state economy)

- 2026 projected growth: 2.7% (exceeds national 2.1% forecast)

- Key sectors: Banking/finance (14% of GDP, Charlotte hub), technology (11%, Research Triangle), manufacturing (12%, pharmaceuticals/automotive), agriculture/food processing (8%)

Employment Landscape:

- Unemployment rate: 3.5% (December 2025)

- Job creation: 89,000 net new jobs in 2025

- Fortune 500 HQs: 12 companies (Bank of America, Lowe’s, Duke Energy, Nucor)

- Major expansions (2023-2025): Apple (Raleigh, $1B investment, 3,000 jobs), Toyota EV battery plant (Greensboro, $1.3B), VinFast EV assembly (Chatham County)

Tax Climate:

- State income tax: 4.5% flat rate (reduced from 5.25% in 2024, trending toward elimination by 2030)

- Property tax: 0.82% average (11th lowest nationally)

- No inheritance or estate tax

- Franchise tax: 0.15% on net worth (applies to LLCs with revenue over $1M)

Legislative Landscape: Balanced Framework Favoring Landlords

Eviction Process Efficiency

5-Day Notice to Quit (Non-Payment):

- North Carolina General Statutes §42-3 allows landlords to issue 10-day demand for rent, then 5-day notice to quit if unpaid

- Average eviction timeline: 4-6 weeks from notice to writ of possession

- No “just cause” requirement for lease non-renewal (month-to-month tenancies)

Court Process:

- Magistrate or District Court handles evictions (fast-track dockets in urban counties)

- Summary ejectment: Hearing within 5-30 days of filing

- Writ of possession: Issued immediately upon judgment

- Sheriff enforcement: 5-10 days for tenant removal post-writ

Pro-Landlord Provisions:

- Self-help evictions prohibited (but enforcement mechanisms are landlord-friendly)

- Lease abandonment: Clear statutory procedures (7-day notice of intent to declare abandonment)

- Damage claims: Landlords can pursue unpaid rent + damages post-eviction

Rent Control & Pricing Autonomy

No Rent Control Statutes:

- North Carolina has no state or local rent control laws (statewide policy against price controls)

- Full pricing autonomy for landlords in all 100 counties

- Annual increases: No caps or notice requirements (except lease terms)

Security Deposit & Lease Terms

Security Deposit Caps (NCGS §42-50):

- 1.5 months’ rent for month-to-month leases

- 2 months’ rent for leases longer than month-to-month

- Return timeline: 30 days with itemized deductions, or 60 days if property damage exceeds deposit

- Pet deposits: Allowed, typically 0.5-1 month rent (separate from security deposit)

Late Fees:

- $15 or 5% of rent (whichever is greater), but only if 5+ days late (NCGS §42-46)

- One-time fee: Cannot charge daily late fees

Lease Terms:

- No mandatory renewal notice (except subsidized housing)

- Landlord entry: Reasonable notice required (no statutory definition, typically 24-48 hours)

Short-Term Rental Regulations

State-Level Framework:

- No statewide restrictions on STR operations

- Occupancy tax: 1% state tax + 1-6% local tourism tax (varies by county)

Local Variations:

- Asheville (Buncombe County): Registration required ($150/year), occupancy limits, residential zones restricted

- Charlotte: No city-wide ban, HOA restrictions apply

- Raleigh: Minimal regulations, owner-occupied STRs encouraged

- Outer Banks: Unrestricted in resort zones, some towns limit STRs in residential areas

- Durham: Pilot program allowing STRs in certain zoning districts

Opportunity: North Carolina coastal markets (Wilmington, Outer Banks) and mountain resorts (Asheville, Boone) generate $2.1B annually in STR revenue, with beach properties averaging $55K-$85K/year.

Property Tax & Appraisal System

Reappraisal Cycles:

- 8-year cycles (county-dependent, most on 4-year or 8-year schedule)

- Appeals process: County Board of Equalization, then NC Property Tax Commission

- Present-use value: Agricultural/forestry land tax reduction (investors can qualify for large parcels)

Tax Rates by Metro:

- Charlotte (Mecklenburg County): $1.05 per $100 assessed value = 1.05% effective rate

- Raleigh (Wake County): $0.726 per $100 = 0.726% effective rate

- Durham (Durham County): $0.7073 per $100 = 0.707% effective rate

- Greensboro (Guilford County): $0.7352 per $100 = 0.735% effective rate

Strategy: North Carolina’s low property taxes (0.82% average) enable 8-12% better cash flow vs. Texas (1.60%) or New Jersey (2.49%).

Top 3 High-Growth Metropolitan Statistical Areas (MSAs)

1. Raleigh-Durham-Cary MSA (Research Triangle)

Population: 2.3 million (+2.0% annual growth, fastest in NC)

Median Home Price: $410,000

Average Rent: $1,850 (single-family), $1,600 (multifamily)

12-Month Appreciation: +5.2%

Cap Rate Average: 5.6% (multifamily), 6.3% (single-family rentals)

Economic Anchors:

- Research Triangle Park: 300+ companies, 55,000 employees (Cisco, IBM, Biogen, Fidelity)

- Universities: Duke, UNC-Chapel Hill, NC State (160,000 combined students/employees)

- Biotechnology: 800+ life sciences companies, $88B annual economic impact

- Apple expansion: $1B campus under construction (3,000 jobs by 2028)

Investment Zones:

- Cary: Suburban stability, $450K-$650K, A-rated schools, corporate rentals, 5-6% CoC

- Chapel Hill: University town, $500K-$750K, student + faculty rentals, 4-5% yields

- Morrisville: Tech corridor, $400K-$550K, Indian/Asian professional demographics, 6-7% CoC

- Durham (Downtown, Brightleaf): Gentrifying, $350K-$500K, young professionals, 6-8% yields

Investment Thesis:

- Apple’s $1B commitment = sustained job growth through 2030

- Biotech boom: NIH funding, Duke clinical trials, pharma R&D = recession-resistant rentals

- No rent control + landlord-friendly evictions = predictable cash flow

Risk Factor: Rapid appreciation (45% since 2020) has compressed cap rates; focus on Durham/Wake Forest for better entry points.

→ Read the full Raleigh-Durham Market Spotlight

2. Charlotte-Concord-Gastonia MSA

Population: 2.8 million (+1.6% annual growth)

Median Home Price: $395,000

Average Rent: $1,750 (single-family), $1,500 (multifamily)

12-Month Appreciation: +4.1%

Cap Rate Average: 5.8% (multifamily), 6.5% (single-family rentals)

Economic Anchors:

- Banking hub: Bank of America HQ (15,000 Charlotte employees), Wells Fargo East Coast operations (26,000 employees), Truist Financial

- Fintech: AvidXchange, LendingTree, 200+ fintech startups (2nd largest US fintech hub after SF)

- Energy: Duke Energy HQ (7,500 employees)

- NASCAR: Team headquarters, Charlotte Motor Speedway (tourism/events)

Investment Zones:

- South End: Urban renewal, $450K-$700K, light rail access, young professionals, 5-6% CoC

- Huntersville/Cornelius: Lake Norman suburbs, $400K-$600K, family rentals, A-schools, 6-7% yields

- Matthews/Ballantyne: Southeast suburbs, $450K-$650K, corporate rentals, 5-6% CoC

- NoDa/Plaza Midwood: Gentrifying, $350K-$550K, artist districts, STR potential, 6-8% yields

Investment Thesis:

- 2nd largest US banking center = high-earning renter pool (average bank salary $95K+)

- No state rent control + balanced landlord laws = institutional investor confidence

- Light rail expansion: Blue Line extension to Matthews (2027) will drive appreciation

Opportunity: Charlotte’s affordability advantage (25% below Raleigh) + comparable job growth = best NC cash flow.

→ Read the full Charlotte Market Spotlight

3. Greensboro-High Point MSA (Triad Region)

Population: 780,000 (+0.9% annual growth, stabilizing)

Median Home Price: $275,000

Average Rent: $1,400 (single-family), $1,200 (multifamily)

12-Month Appreciation: +3.3%

Cap Rate Average: 7.2% (best cash flow in NC)

Economic Anchors:

- Manufacturing: Toyota EV battery plant ($1.3B, 1,750 jobs), Honda Aircraft, Volvo trucks

- Logistics/distribution: FedEx Ground hub, Amazon fulfillment (3 facilities)

- Higher education: UNC-Greensboro, NC A&T State (40,000 combined students)

- Furniture industry: High Point Market (world’s largest furniture trade show, 75,000 visitors biannually)

Investment Zones:

- Downtown Greensboro: Urban renewal, $200K-$350K, young professionals, 7-9% CoC

- Summerfield/Oak Ridge: Suburban growth, $300K-$450K, family rentals, 6-7% yields

- High Point (Emerywood): Established neighborhoods, $250K-$400K, furniture exec rentals

- Burlington: Value plays, $180K-$280K, 8-10% yields, textile industry rebound

Investment Thesis:

- $275K median price = lowest barrier to entry among NC metros

- 7-9% cash-on-cash returns on turnkey properties

- Toyota battery plant = 1,750 direct jobs + 5,000 indirect (suppliers, services)

Opportunity: Greensboro’s manufacturing renaissance (Toyota, Honda) + low entry costs = best NC cash flow market.

→ Read the full Greensboro Market Spotlight

Investment Risk Profile: Balanced Assessment for 2026

Risks to Monitor

1. Appreciation Compression (Raleigh/Charlotte)

- Challenge: 45% Raleigh appreciation (2020-2025), 38% Charlotte

- Cap rate compression: Raleigh at 5.6%, Charlotte at 5.8% (vs. 7-8% historical)

- Mitigation: Target suburbs (Wake Forest, Matthews, Cornelius) or pivot to Greensboro/Durham

2. Hurricane/Coastal Flood Risk

- Exposure: Wilmington, Outer Banks, coastal counties

- Insurance: Wind/hail + flood coverage $3,500-$6,000/year in coastal zones

- Mitigation: Inland markets (Raleigh, Charlotte, Greensboro) minimize climate risk, or target elevated coastal properties

3. Property Tax Reassessments

- Cycles: Wake County (Raleigh) reassessed 2024, next in 2032; Mecklenburg (Charlotte) reassessed 2023

- Increases: Raleigh properties saw 15-30% appraisal jumps in 2024

- Mitigation: Appeal assessments (40% success rate), budget 8-12% annual tax increases in growth markets

4. Manufacturing Cyclicality (Triad)

- Risk: Greensboro/High Point tied to automotive/furniture cycles

- Recession sensitivity: Manufacturing job losses 2008-2010 (15% decline)

- Diversification: Toyota/Honda EV plants less cyclical than traditional manufacturing

Strengths Mitigating Risks

Demographic Tailwinds:

- Northeast migration: High-earners from NY, NJ, CT relocating for lower taxes, cost of living

- Tech/biotech jobs: Average salary $105K+ in Research Triangle

- Retiree influx: Asheville/coastal markets attract 12,000+ retirees annually

Infrastructure Investment:

- I-77 Express Lanes: $650M Charlotte corridor upgrade (completed 2024)

- Triangle Expressway expansion: $300M Raleigh toll road extension (2026-2028)

- Charlotte Airport: $2.5B terminal modernization (2025-2030), 50M passengers annually

Institutional Capital Confidence:

- $6.8 billion in NC multifamily acquisitions (2024-2025) by CBRE, JLL, Greystar

- Single-family rental: Invitation Homes, Progress Residential own 11,500+ NC homes

FAQ: North Carolina Real Estate Investment Guide

Lender Perspective: Optimal Loan Products for North Carolina Investments

DSCR Loans (Debt Service Coverage Ratio)

- Best for: Cash-flowing properties in Greensboro, Durham, Charlotte suburbs

- Typical terms: 80% LTV, 1.15x-1.25x DSCR requirement, 7.5-8.5% rates (2026)

- No income verification: Ideal for out-of-state investors, self-employed

- NC advantage: Low property taxes (0.82%) improve DSCR ratios by 10-15% vs. Texas/NJ

- Lender recommendation: LenderTribune.com/loans specializes in NC DSCR programs

Fix & Flip Loans

- Best for: Charlotte gentrification zones (NoDa, Plaza Midwood), Durham urban core, Raleigh suburbs

- Terms: 90% of purchase + 100% of rehab, 9-12 month terms, 10-13% rates

- Exit strategy: Sell retail or refinance into long-term rental

- Sweet spot: $300K-$450K purchase price for highest margins

Short-Term Rental Financing

- Best for: Asheville mountain cabins, Outer Banks beach houses, Charlotte downtown condos

- Terms: 75-80% LTV, DSCR based on STR income projections (AirDNA reports), 8.5-10% rates

- Requirement: 6-12 months operating history or strong market comps

- Advantage: Outer Banks properties underwrite at $5,000-$8,000/month STR income vs. $2,000 long-term rent

Portfolio Loans

- Best for: Investors with 5+ NC properties across metros

- Terms: Cross-collateralization, blanket financing, 6.8-8.2% rates

- Advantage: Simplified underwriting, relationship pricing, faster closings (14-21 days)

Ready to capitalize on North Carolina’s balanced growth and landlord-friendly framework?

- Explore North Carolina Investment Properties →

- Get Pre-Approved for NC DSCR Loans →

- Download: North Carolina Market Data Dashboard (2026) →

- Read City Spotlights: Charlotte | Raleigh | Durham | Greensboro

Related State Guides:

- Texas Real Estate Investment Guide 2026

- Florida Real Estate Investment Guide 2026

- Tennessee Real Estate Investment Guide 2026

Top North Carolina City Spotlights:

- Charlotte Market Analysis

- Raleigh-Durham Market Analysis

- Greensboro Market Analysis

- Asheville Market Analysis

Last Updated: February 2026 | Data Sources: US Census Bureau, North Carolina Realtors, FRED Economic Data, NC General Statutes, LenderTribune Market Research

Disclaimer: This guide is for informational purposes only and does not constitute financial or legal advice. Consult with licensed professionals before making investment decisions.