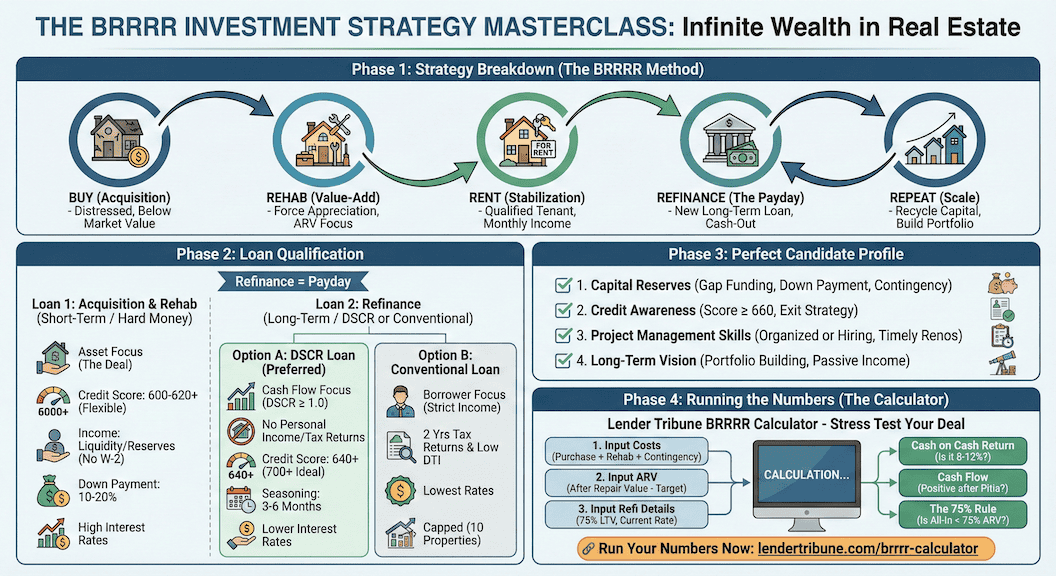

The BRRRR method—Buy, Rehab, Rent, Refinance, Repeat—is the gold standard for real estate investors who want to scale their portfolios without running out of cash. Unlike a traditional buy-and-hold strategy, where you save a 20% down payment for every single property, BRRRR allows you to recycle the same capital over and over again.

This masterclass will break down exactly how to execute this strategy, how to qualify for the specific loans you need at each stage, and how to run the numbers using the Lender Tribune BRRRR Calculator to ensure you never buy a bad deal.

Phase 1: The Strategy Breakdown

1. Buy (Acquisition)

You purchase a distressed property below market value. This is not a turnkey home; it needs work. The goal is to buy it at a price that provides a sufficient discount so that, after you pay for renovations, your total cost is still significantly lower than the property’s future value.

2. Rehab (Value-Add)

You renovate the property to force appreciation. This isn’t just about making it pretty; it’s about making it safe, functional, and durable for tenants. The renovation must significantly increase the property’s appraisal value (ARV – After Repair Value).

3. Rent (Stabilization)

You place a qualified tenant in the property. This step is crucial because lenders will not refinance the property unless it is “stabilized”—meaning it is generating monthly rental income.

4. Refinance (The Payday)

This is the magic step. Once the property is renovated and rented, you go to a bank or lender to get a new long-term loan based on the new, higher value of the property, not what you bought it for. You take a “Cash-Out Refinance” to pay off your initial high-interest acquisition loan and put your original down payment back in your pocket.

5. Repeat (Scale)

With your initial capital back in your bank account, you use it to buy the next property and do it all again.

Phase 2: Qualifying for the Loans

A successful BRRRR requires two different types of loans. You cannot use a standard 30-year mortgage for a property that is falling apart. You need short-term money to buy it and long-term money to keep it.

Loan 1: The Acquisition & Rehab Loan

Also known as: Hard Money Loan, Bridge Loan, or Fix-and-Flip Loan.

This is a short-term (12–24 months) loan used to purchase a distressed property and cover repairs.

- Qualification Focus: The “Asset” (The Deal).

- Credit Score: Flexible. Lenders often accept scores as low as 600–620, though 680+ gets you lower interest rates and fees.

- Income: No W-2 required. Lenders are more interested in your liquidity (cash reserves) than your monthly salary.

- Down Payment: Typically 10%–20% of the purchase price. Some lenders will finance 100% of the renovation costs if the deal is good.

- Experience: Helpful but not mandatory. First-time investors may see slightly lower leverage (e.g., 85% of costs instead of 90%).

Loan 2: The Refinance Loan

Also known as: DSCR Loan or Conventional Investment Loan.

This is the long-term (30-year) loan that pays off the Hard Money loan.

Option A: DSCR Loan (Preferred for Investors)

- Qualification Focus: The Property’s Cash Flow.

- What is DSCR? Debt Service Coverage Ratio. Lenders want to see a ratio of 1.0 or higher. This means the monthly rent covers the monthly mortgage payment (PITIA).

- Income: No personal income verification. No tax returns or W-2s needed.

- Credit Score: Typically 640+ minimum. Ideally, 700-720+ for the best terms.

- Seasoning: Most lenders require you to own the property for 3 to 6 months before refinancing, though some offer “no seasoning” options if the renovation was substantial.

Option B: Conventional Loan (Fannie Mae/Freddie Mac)

- Qualification Focus: You (The Borrower).

- Income: Strict. Requires 2 years of tax returns and a low Debt-to-Income (DTI) ratio.

- Pros: Slightly lower interest rates than DSCR loans.

- Cons: Harder to qualify for as you scale (capped at 10 financed properties).

Phase 3: The Perfect Candidate for a BRRRR Deal

Not everyone is built for BRRRR investing. The “Perfect Candidate” has the following profile:

- Capital Reserves: You don’t need to be rich, but you need “gap funding.” Even with a loan, you need cash for the down payment (15-20% of the purchase price), closing costs, and a contingency fund for when renovations go over budget.

- Credit Awareness: You have a credit score of at least 660. This ensures you can exit the hard money loan into a cheaper long-term loan.

- Project Management Skills: You are organized enough to manage contractors or smart enough to hire a project manager. A delayed renovation eats your profits in holding costs.

- Long-Term Vision: You aren’t looking for a quick flip fee; you want to build a portfolio of assets that pay you while you sleep.

Phase 4: Running the Numbers (The Calculator)

You cannot guess in real estate. You must use math. This is where the Lender Tribune BRRRR Calculator becomes your most valuable tool.

How to use the calculator to “Stress Test” your deal:

- Input Purchase & Rehab Costs:

- Enter your Purchase Price (what you pay the seller).

- Enter your Rehab Budget (be conservative; add 10% for overages).

- Tip: The calculator will show your “Total All-In Cost.” This number must be significantly lower than the ARV.

- Input the ARV (After Repair Value):

- This is what the house will be worth after you fix it.

- The 75% Rule: A perfect BRRRR deal usually means your “Total All-In Cost” is roughly 75% of this ARV number. If it is, you can likely refinance 100% of your cash back out.

- Input Refinance Loan Details:

- Set the Loan-to-Value (LTV) to 75% (standard for cash-out refis).

- Enter a current interest rate for a DSCR loan (typically 0.5% – 1% higher than a regular mortgage).

- Analyze the Output:

- Cash on Cash Return: If you leave some money in the deal, is it earning you at least 8-12%?

- Cash Flow: After the refinance, does the rent cover the new mortgage, taxes, and insurance? If the calculator shows a negative cash flow, do not buy the deal.

Ready to see if your deal works? 👉 Run your numbers now on the Lender Tribune BRRRR Calculator