Stallion Funding’s footprint is strategically diverse, covering a massive swath of the U.S. from the East Coast to the Great Plains. Their programs cater to the three pillars of modern real estate investment: Fix & Flip, Ground-Up Construction, and Bridge Financing.

1. Fix & Flip Loans (Nationwide)

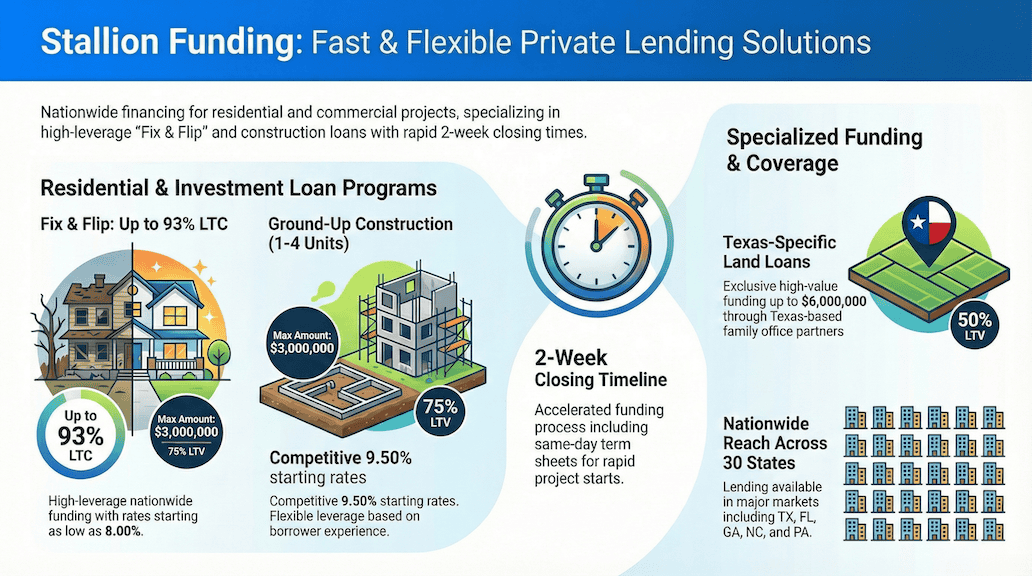

For investors looking to modernize aging housing stock, Stallion offers some of the most competitive leverage in the industry.

- Leverage: Up to 85–93% LTC (Loan-to-Cost)

- Max LTV: 75%

- Rates: Starting as low as 8.00%

- Closing Time: 2 weeks

- The Bottom Line: With same-day term sheets, investors can bid with the confidence of cash buyers, knowing their financing is ready to move as fast as their contractors.

2. Ground-Up Construction (Nationwide)

With 1.4 million housing permits authorized nationally, the demand for new residential units (1–4 units) remains a top priority for 2026.

- Rates: Starting at 9.50%

- Flexibility: LTC is scaled based on borrower experience, rewarding seasoned builders with higher leverage.

- Loan Amounts: Up to $3,000,000

| Fix & Flip | Ground-Up Construction | Bridge Loans | Land Loans | |

| Lending Area | Nationwide (30 States) | Nationwide (30 States) | Nationwide (30 States) | Texas Only |

| Leverage (LTC) | Up to 85–93% | Up to 85–93% | Deal Specific | N/A |

| Max LTV | 75% | 75% | Deal Specific | 50% |

| Loan Amounts | Up to $3,000,000 | Up to $3,000,000 | Up to $3,000,000 | Up to $6,000,000 |

| Starting Rates | As low as 8.00% | As low as 9.50% | Competitive | Competitive |

| Closing Time | 2 Weeks | 2 Weeks | 2 Weeks | 2 Weeks |

| Best For | Value-add projects | 1–4 unit builds | Rapid acquisition | TX Site development |

3. Bridge Loans (Nationwide)

When a deal needs to close “yesterday” but the long-term financing isn’t quite ready, Stallion’s bridge loans provide the necessary “breathable” capital. These are deal-specific and competitively priced to ensure that high-potential projects don’t stall at the starting line.

The Texas Specialist: Exclusive Land Opportunities

While Stallion’s residential programs are nationwide, they retain a “home-field advantage” in the Lone Star State. Through a specialized family office partnership, Stallion Funding offers Land Loans exclusively in Texas.

With loan amounts reaching up to $6,000,000 and a 50% LTV, this program is a vital resource for developers looking to secure prime Texas acreage before the next wave of suburban expansion.

Why the 2026 Market Demands Private Capital

The current economic landscape has made asset-based lending more relevant than ever. Private lenders like Stallion Funding prioritize property value and project viability over rigid debt-to-income ratios that often disqualify entrepreneurs from traditional bank loans.

“In 2026, speed is the ultimate currency,” says the Stallion team. “If you have to wait 60 days for a bank appraisal, the deal is already gone. We provide a ‘yes’ that actually means ‘yes’ in two weeks or less.”

Where Stallion Lends

Investors can access Stallion’s capital in: AL, AR, FL, CO, CT, DE, DC, GA, IA, IL, IN, KS, KY, LA, MD, MA, MI, MO, NJ, NC, OH, OK, PA, RI, SC, TN, TX, VA, WA, and WI.

Get in the Saddle

Ready to scale your portfolio? Connect with Stallion Funding’s dedicated originators to secure your next term sheet.

Contact Information: Juan Carlos Blandon | Loan Originator Mobile: 737-235-1385 | Office: 512-219-5558 Address: 10119 Lake Creek Pkwy, Suite 202, Austin, TX 78729 Web: stallioncap.com